Offer digital financial services to your customers quickly, easily, and safely.

Learn more

What is Credable

Credable is the Digital Banking Platform that is driving the future of banking by embedding financial services in businesses across emerging markets.

We partner with financial institutions and businesses to launch financial services including credit, savings, and payments products on our B2B2C digital infrastructure.

In using our Digital Banking Platform, Credable provides you with an end-to-end solution, allowing you to focus on your core business while we build out your financial services business line.

Our partnership model means we succeed only if our products succeed. Whether you are a business looking to embed financial services into your product or a financial institution trying to expand into the digital banking space - we can enable you.

Key Features

Whether you are a business looking to embed financial services into your product or a financial institution trying to expand to digital products we can enable you.

Credable partners with financial institutions to provide them with access to the future of banking in digital channels, at scale.

We work with various types of financial institutions including banks, micro-finance institutions, and credit-funds to enable an array of digital banking products for our business partners.

We partner with you and provide the platform that builds and grows banking products profitably

and prices risk

accurately.

Our scoring processes, data analytics and digital credit experience ensures

efficient risk management and

attractive returns for your capital.

We enable Financial institutions to leapfrog the digital divide between legacy banking and FinTech without the need of building any internal capacity or infrastructure.

Credable partners with you whether your business is an eCommerce platform, a fintech, MNO or any other business with a digital channel that is active with your customers.

You benefit from an incremental and significant revenue stream from Day 1, increasing the value of your business instantly.

Our embedded financial services range from savings to various types of credit-based products

that are

tailored for the

use-case and type of customer on your platform.

We'll work with you to determine which

products are best

for your

customers.

Credable handles the entire process end-to-end so that you can focus on building and growing

your core business.

Our

solution brings the design and development of the right products for your customers, the right

regulatory and compliance

frameworks, the necessary funding, and an actively managed portfolio.

Use Cases

With Credable, the underbanked have access to relevant financial services directly delivered in the channels they are already in.

Credable is able to accurately and fairly price financial products by using data from those channels.

A farmer receives a loan against his milk sales to pay for better cow feed

Product Offering- Working Capital Finance

- Business AgriTech

Employee wants to upgrade to a 4G enabled phone to become more efficient at work

Product Offering- Asset financing

- Business

- MNO

Small-business owner in a rural area getting a loan to expand her business

Product Offering- SME Lending / Overdraft

- Business

- Fintech

Student wanting to start saving for a motorbike and to pay for goods and services

Product Offering- Savings / Credit / Payments

- Business

- NeoBank

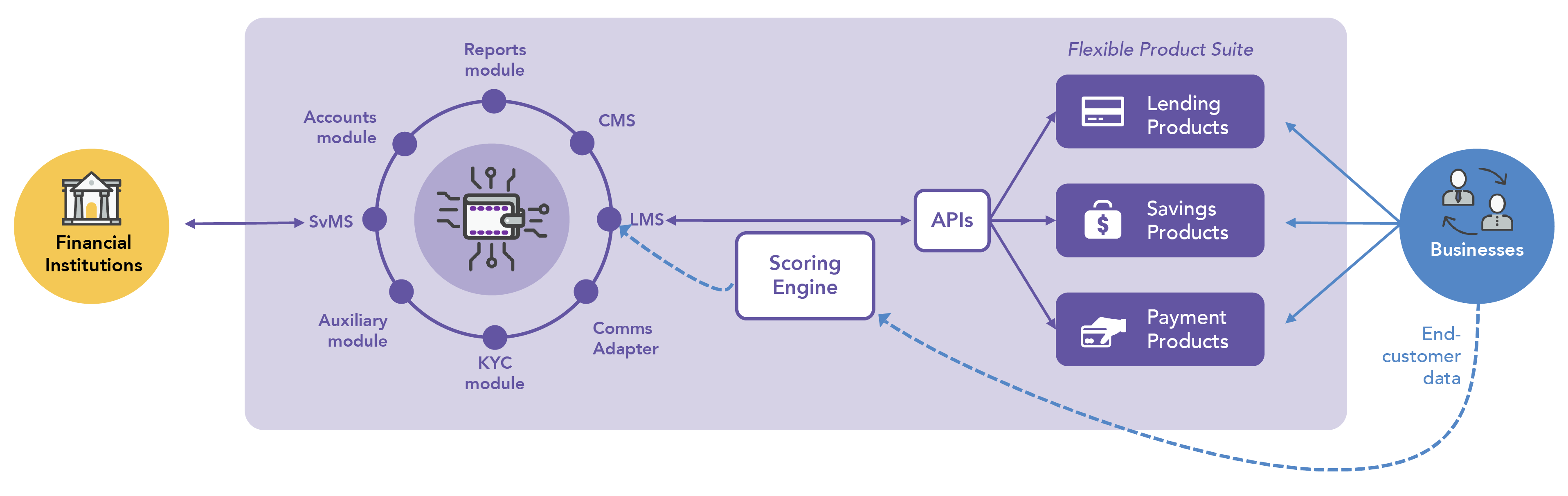

The Credable Platform

Credable's Digital Banking Platform enables a wide range of products for customers, quickly and easily.

Join The Team

Work with a group of brilliant minds.

Get in touch with us

Contact Us

contactus@credable.io

Database Administrator

The Role

Our 2025 roadmap and OKRs are ambitious and focused around tripling our live portfolio, while also diversifying our products in terms of markets, partners, and outcomes.

We are seeking a highly skilled Database Administrator (DBA) to design, implement, and maintain our database systems, ensuring optimal performance, security, and reliability. The DBA will play a critical role in managing databases across both cloud and on-premises environments, working closely with development, operations, and security teams to support infrastructure, scalability, and compliance needs.

This position requires a highly organized and driven individual that can support the organization in achieving these lofty goals for 2025, while also shaping the future of digital banking in the space at large.

Position title: Database Administrator

Reports to: Head of Data Engineering/ CTO

Coverage: UAE (HQ), Kenya, Tanzania, and Uganda + other new markets

Base: Nairobi, Kenya with occasional travel

Key Responsibilities

- Design, configure, and maintain database systems across cloud and on-premises environments, ensuring seamless integration with existing infrastructure.

- Monitor database performance and health, proactively identifying and resolving bottlenecks, failures, and inefficiencies to maintain system stability.

- Implement and manage backup and disaster recovery strategies to ensure data availability, integrity, and business continuity.

- Enforce strict security measures, including access controls, encryption, and compliance with regulatory standards to protect sensitive data.

- Manage system capacity, high availability configurations, and failover mechanisms to ensure continuous and reliable database operations.

- Apply system updates and patches, addressing vulnerabilities while minimising downtime and maintaining performance.

- Develop and automate database maintenance processes, improving efficiency through scripting and workflow automation.

- Collaborate with development, operations, and security teams to support database schema design, performance tuning, and operational management.

- Optimise resource usage and infrastructure, balancing performance, scalability, and cost efficiency.

- Oversee data replication across cloud and on-premises environments, ensuring seamless extraction, transformation, and loading (ETL) for analytical and operational needs.

- Manage query execution, indexing, partitioning, and clustering strategies to optimise database workloads and ensure efficient use of compute resources.

Person Specification

- Required

- Proven experience in database administration, architecture, and management across cloud (AWS, Azure, GCP) and on-premises environments.

- Strong expertise in SQL and NoSQL databases (e.g., PostgreSQL, MySQL, SQL Server, MongoDB, Cassandra).

- Experience in database performance tuning, query optimisation, and indexing strategies.

- Hands-on experience with high availability, replication, and disaster recovery strategies.

- Proficiency in backup and recovery solutions, ensuring data integrity and business continuity.

- Strong understanding of database security principles, including access control, encryption, and compliance frameworks (e.g., GDPR, ISO 27001).

- Experience with ETL processes and data replication between cloud and on-premise environments.

- Familiarity with automation and scripting using languages such as Python, Bash, or PowerShell for database maintenance and management.

- Knowledge of infrastructure monitoring tools to proactively identify and resolve database issues.

- Experience collaborating with development, operations, and security teams to align database architecture with business needs.

- Preferred

- Exposure to big data technologies (e.g., Hadoop, Spark, Snowflake) and their integration with traditional databases.

- Experience working with containerised environments (e.g., Docker, Kubernetes) and their impact on database management.

- Knowledge of IaC (Infrastructure as Code) tools such as Terraform or Ansible for database deployment and configuration management.

- Experience managing multi-region and distributed database systems for global scalability.

- Understanding of AI/ML-driven database optimisation techniques.

- Previous experience in financial services, fintech, or other high-transaction environments with strict regulatory requirements.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratising access to finance across emerging markets. Our team operates across offices in Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen connections with colleagues and partners.

We value the impact of working together in person, believing it often delivers results that remote work cannot fully achieve. While work-from-home (WFH) is available for specific requests or situations, our culture emphasises the advantages of being physically present and engaged as a team.

We are entering an exciting phase of hyper-growth, expanding into new markets, scaling operations, and evolving our structures to shape the future of Credable in 2025. We are looking for energetic, curious individuals who are passionate about our vision and eager to create value while driving innovation and growth in the markets we operate in.We’re thrilled to have you join us as we reshape the financial landscape in emerging markets.

Benefits

- Health Insurance for you and your direct dependants.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities (Internal and External).

Quality Assurance (QA) Tester

The Role

The QA Tester will play a key role in ensuring the quality, reliability, and performance of our products. You will work closely with developers, product managers, and other stakeholders to test software solutions, identify bugs, and validate fixes. Your role will involve both manual and automated testing, ensuring our applications meet high security, functionality, and usability standards.

Our 2025 roadmap and OKRs are ambitious and focused around tripling our live portfolio, while also diversifying our products in terms of markets, partners, and outcomes. This position is ideal for someone with a keen eye for detail, strong analytical skills, and a passion for delivering high-quality software in a fast-paced, high-growth fintech environment.

Position title: QA Tester

Reports to: Head of Product & Projects

Coverage: UAE (HQ), Kenya, Tanzania, and Uganda + other new markets

Base: Nairobi, Kenya

Key Responsibilities

- Develop, execute, and maintain test cases, test scripts, and test plans to ensure comprehensive coverage of new features and system updates. This is across the engineering, Data Science, and Data Engineering teams.

- Conduct manual and automated testing to validate application functionality and ensure seamless integration of new updates.

- Implement and maintain automated test scripts using tools such as Selenium, Cypress, or Playwright to improve efficiency and accuracy.

- Log, track, and document software defects, providing clear reports to developers for timely resolution.

- Assess application scalability and performance under different conditions, identifying bottlenecks and areas for improvement.

- Ensure fintech applications comply with security, regulatory, and data privacy requirements.

- Work closely with developers and product managers to refine requirements, improve test coverage, and validate fixes.

- Contribute to refining QA processes, identifying automation opportunities, and improving testing efficiency.

- Support business teams and clients during UAT, ensuring final releases meet user expectations.

- Responsible for analyzing inbound support queries to understand underlying issues and propose fixes to improve product and platform performance.

Person Specification

- Required

- Experience with hands-on testing of web and mobile applications.

- Strong knowledge of testing methodologies, tools, and best practices, including functional, regression, performance, and security testing.

- Proficiency in automation testing frameworks such as Selenium, Cypress, Playwright, or similar.

- Experience writing and executing test cases, test scripts, and test plans for complex applications.

- Familiarity with bug tracking tools like Jira, Bugzilla, or TestRail for defect reporting and management. Understanding of API testing using tools like Postman or RestAssured.

- Knowledge of CI/CD pipelines and integrating automated tests within the development lifecycle.

- Experience in testing fintech applications, ensuring compliance with security, regulatory, and data privacy standards.

- Ability to collaborate closely with developers and product managers.

- Experience supporting UAT, working with business teams and clients to validate application functionality.

- Familiarity with scripting languages such as Python, Java, or JavaScript for test automation.

- Exposure to cloud-based testing environments such as AWS, Azure, or Google Cloud.

- Understanding of database testing, including writing SQL queries to validate data integrity.

- Preferred

- ISTQB or other relevant QA certifications.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratising access to finance across emerging markets. Our team operates across offices in Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen connections with colleagues and partners.

We value the impact of working together in person, believing it often delivers results that remote work cannot fully achieve. While work-from-home (WFH) is available for specific requests or situations, our culture emphasises the advantages of being physically present and engaged as a team.

We are entering an exciting phase of hyper-growth, expanding into new markets, scaling operations, and evolving our structures to shape the future of Credable in 2025. We are looking for energetic, curious individuals who are passionate about our vision and eager to create value while driving innovation and growth in the markets we operate in. We’re thrilled to have you join us as we reshape the financial landscape in emerging markets.

Benefits

- Health Insurance for you and your direct dependants.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities (Internal and External).

Head of Comms & Marketing

The Role

Credable Group is seeking a dynamic and strategic Head of Communications & Marketing to define and elevate our brand voice across all external touchpoints. This role will be instrumental in shaping how we engage with our key stakeholders—partners, customers, and investors—through compelling storytelling, consistent messaging, and high-impact marketing initiatives. The ideal candidate will be responsible for crafting and executing a cohesive communications and marketing strategy that aligns with Credable’s vision as a leading fintech innovator.

As a core part of the leadership team, this role requires a blend of creativity, strategic thinking, and executional excellence. From developing our content calendar to managing brand visuals, orchestrating industry events, and refining our social media presence, the Head of Communications & Marketing will ensure that our messaging is not only consistent but also deeply resonates with our audience. This is a hands-on role for a marketing leader who thrives in fast-paced environments and is eager to build a strong brand presence for a growing fintech company.

Position title: Head of Comms and Marketing

Reports to: Head of Product and Projects

Coverage: UAE (HQ), Kenya, Tanzania, and Uganda + other new markets

Base: Nairobi, Kenya

Key Responsibilities

- Develop and execute a comprehensive communications and marketing strategy to engage external stakeholders, including partners, customers, and investors.

- Shape and refine Credable Group’s brand voice, ensuring consistency across all platforms, including press releases, social media, and thought leadership pieces.

- Oversee content creation and marketing materials, managing a structured content calendar that aligns with business objectives.

- Lead social media strategy and execution, optimizing our presence across platforms to drive engagement and brand awareness (includes website, social platforms, blogs, et al).

- Manage public relations and media outreach, building relationships with industry journalists and securing positive press coverage.

- Organize and oversee events, webinars, and industry conferences to strengthen Credable’s visibility and network.

- Collaborate with internal teams (product, sales, and leadership) to ensure messaging aligns with business priorities and market positioning.

- Track and analyze marketing performance metrics, using insights to refine strategies and optimize marketing efforts.

Person Specification

- Required

- 3 to 5 years of experience in marketing, communications, or a related field, preferably in fintech, financial services, or startups.

- Strong understanding of brand development, content strategy, and digital marketing trends.

- Experience with key marketing tools, such as HubSpot, Google Analytics, SEO tools, and social media management platforms.

- Proven ability to craft compelling narratives and produce high-quality written and visual content.

- Strong event planning and stakeholder engagement skills, with experience organizing conferences or webinars.

- A proactive, hands-on leader with excellent project management and execution abilities.

- Bachelor’s degree in Marketing, Communications, Business, or a related field (relevant certifications in digital marketing or PR are a plus).

- Preferred

- Deep knowledge and strong relationships within the Fintech Industry is a plus, but not required.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratising access to finance across emerging markets. Our team operates across offices in Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen connections with colleagues and partners.

We value the impact of working together in person, believing it often delivers results that remote work cannot fully achieve. While work-from-home (WFH) is available for specific requests or situations, our culture emphasises the advantages of being physically present and engaged as a team.

We are entering an exciting phase of hyper-growth, expanding into new markets, scaling operations, and evolving our structures to shape the future of Credable in 2025. We are looking for energetic, curious individuals who are passionate about our vision and eager to create value while driving innovation and growth in the markets we operate in. We’re thrilled to have you join us as we reshape the financial landscape in emerging markets.

Benefits

- Health Insurance for you and your direct dependants.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities (Internal and External).

Tech Support Lead

The Role

Our 2025 roadmap and OKRs are ambitious and focused around tripling our live portfolio, while also diversifying our products in terms of markets, partners, and outcomes.

The Tech Support Lead will be responsible for managing and overseeing the technical support function, ensuring seamless resolution of customer and internal technical issues. This role will involve leading a team of support engineers, optimising support processes, and collaborating with cross-functional teams to enhance user experience. The ideal candidate will have strong technical expertise, leadership skills, and a customer-first mindset to drive operational efficiency and service excellence.

This position requires a highly organised and driven individual that can support the organisation in achieving these lofty goals for 2025, while also shaping the future of digital banking in the space at large.

Position title: Tech Support Lead

Reports to: CTO

Coverage: UAE (HQ), Kenya, Tanzania, and Uganda + other new markets

Base: Dar es Salaam, Tanzania with occasional travel.

Key Responsibilities

- Lead and mentor the tech support team, ensuring high performance, professional growth, and continuous skill development.

- Oversee troubleshooting and resolution of customer and internal technical issues, ensuring timely and effective solutions.

- Develop and implement best practices for incident management, problem resolution, and escalation procedures.

- Collaborate with engineering, product, and operations teams to address recurring technical challenges and improve system reliability.

- Monitor support metrics and KPIs, ensuring service levels and response times meet company standards.

- Maintain and improve technical documentation, including FAQs, troubleshooting guides, and system knowledge bases.

- Act as the key escalation point for critical technical issues, coordinating responses and ensuring timely resolution.

- Drive automation and efficiency improvements in support workflows, leveraging tools and technology to optimise processes.

- Stay updated on emerging technologies and industry trends to continuously enhance the technical support function.

- Ensure compliance with security policies and data protection regulations in all support activities.

Person Specification

- Required

- Strong troubleshooting skills across cloud-based platforms, APIs, and enterprise software.

- Experience managing support teams, including coaching, performance tracking, and workflow optimisation.

- Proven expertise in incident management, escalation handling, and resolution of technical issues.

- Proficiency in support tools and ticketing systems such as Jira, Zendesk, or Freshdesk.

- Familiarity with networking, databases, and system integrations, particularly in a fintech or SaaS environment.

- Excellent communication and stakeholder management skills, with the ability to translate technical issues into business context.

- Experience in fintech or financial services, particularly with payment platforms, digital lending, or banking APIs.

- Knowledge of DevOps and cloud environments (AWS, Azure, or Google Cloud).

- Experience with automation tools and AI-driven support solutions to improve efficiency.

- Technical background in scripting or coding (e.g., Python, SQL, Bash) to support debugging and automation.

- Understanding of cybersecurity principles and best practices in tech support.

- ITIL certification or other relevant support/process improvement certifications.

- Preferred

- 5+ years of experience in technical support, IT operations, or a similar role, with at least 2 years in a leadership capacity.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratising access to finance across emerging markets. Our team operates across offices in Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen connections with colleagues and partners.

We value the impact of working together in person, believing it often delivers results that remote work cannot fully achieve. While work-from-home (WFH) is available for specific requests or situations, our culture emphasises the advantages of being physically present and engaged as a team.

We are entering an exciting phase of hyper-growth, expanding into new markets, scaling operations, and evolving our structures to shape the future of Credable in 2025. We are looking for energetic, curious individuals who are passionate about our vision and eager to create value while driving innovation and growth in the markets we operate in. We’re thrilled to have you join us as we reshape the financial landscape in emerging markets.

Benefits

- Health Insurance for you and your direct dependants.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities (Internal and External).

Head of DevOps

The Role

The Head of DevOps role is a critical position that supports the technical and product teams to ensure high-quality, timely delivery of sprints. This individual will act as the glue between cross-functional departments, supporting the technical team with key processes, documentation, stakeholder engagement, and internal ways of working.

As part of our ambitious 2025 roadmap, we are focused on tripling our live portfolio and diversifying our products across markets, partners, and outcomes. This role requires a highly organized and driven individual who can support the organization in achieving these objectives while shaping the future of digital banking.

Key Responsibilities

- Collaborate with the CTO, Head of Projects, and technical team to manage tasks, prioritize work, and implement operational processes.

- Develop and maintain documentation for processes, systems, and workflows to ensure clarity and alignment.

- Engage with business unit heads to align on timelines, blockers, and challenges, ensuring smooth project execution.

- Act as the primary point of communication for cross-functional alignment, translating business objectives into actionable workflows.

- Support technical teams by managing internal tickets and projects for timely resolution.

- Provide technical support to client-facing teams, ensuring clear communication and resolution of technical issues.

- Implement best practices across the organization to enhance efficiency and collaboration.

- Identify opportunities to streamline operations and improve communication between technical and business units.

Person Specification

- Required:

- Bachelor’s degree in Computer Science, Information Technology, Business Administration, or equivalent work experience.

- 3+ years of experience in DevOps, technology management, or operations.

- Strong understanding of DevOps concepts, including CI/CD pipelines, infrastructure as code (IaC), and cloud-based architectures.

- Solid knowledge of Agile methodologies and project management tools like JIRA, Trello, or Notion.

- Preferred:

- Familiarity with cloud platforms (AWS, Azure, GCP) and DevOps tools.

- Proactive and collaborative problem-solver focused on continuous improvement.

- Ability to manage multiple tasks and shifting priorities in a fast-paced environment.

- Strong business acumen with the ability to translate business needs into technical workflows.

- Proven project management or technical coordination experience with a track record of successful project delivery.

- Excellent communication skills, engaging both technical and non-technical stakeholders effectively.

- Experience in fintech or credit space working with technical teams.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratizing access to finance across emerging markets. Our team operates across offices in Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen connections with colleagues and partners.

We emphasize in-person collaboration, believing it fosters better results. While work-from-home (WFH) is available for specific cases, our culture values physical engagement.

Benefits

- Health Insurance for you and your dependents.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities.

Behavioural Scientist

The Role

Our 2025 roadmap and OKRs are ambitious and focused around tripling our live portfolio, while also diversifying our products in terms of markets, partners, and outcomes. We are looking for a highly analytical and research-driven Behavioural Scientist to lead the exploration of customer behaviour, decision-making patterns, and psychological responses to messaging, content, and product interactions. This role sits at the intersection of psychology, data science, and behavioural economics, applying both qualitative and quantitative methodologies to understand and influence customer engagement, product adoption, and response rates.

Position title: Behavioural Scientist

Reports to: Head of Data Science

Coverage: UAE (HQ), Kenya, Tanzania, and Uganda + other new markets

Base: Can be based in any of our hubs in Dubai, Portol or Kenya.

Travel: Yes

Key Responsibilities

- Conduct qualitative and quantitative research to analyse customer behaviour, engagement patterns, and decision-making processes.

- Apply behavioural science principles and psychometric models to design experiments that test user responses to different messaging, content formats, and product interactions.

- Develop and implement A/B tests, behavioural interventions, and nudging strategies to influence customer actions and improve engagement metrics.

- Use statistical analysis, machine learning, and advanced modelling to assess and predict customer responses.

- Collaborate with marketing, product, and UX teams to refine messaging, optimise content delivery, and improve user experience based on behavioural insights.

- Leverage psychological theories and cognitive biases to enhance customer decision-making frameworks.

- Evaluate and measure the impact of interventions using key behavioural and business performance metrics.

- Create and maintain data-driven reports, dashboards, and behavioural insights presentations for stakeholders.

- Stay up to date with the latest research in behavioural science, consumer psychology, and experimental design, applying best practices to real-world business challenges.

- Work closely with data teams to integrate behavioural insights into predictive models and customer segmentation strategies.

Person Specification

- Required

- Strong background in behavioural science, psychology, or psychometrics, with a focus on customer behaviour analysis.

- Proven experience conducting qualitative and quantitative research, including survey design, interviews, and focus groups.

- Expertise in experimental design, A/B testing, and behavioural interventions to assess customer engagement and response rates.

- Proficiency in statistical analysis and data modelling, using tools such as R, Python, or SQL.

- Ability to apply cognitive psychology and behavioural economics principles to real-world business challenges.

- Hands-on experience working with large datasets, drawing insights to inform strategic decisions.

- Strong analytical and critical thinking skills, with the ability to translate behavioural data into actionable recommendations.

- Experience collaborating with product, UX, marketing, and data teams to implement behavioural insights.

- Excellent communication skills, with the ability to present complex findings in a clear and impactful manner.

- Preferred

- Advanced degree (Master’s or PhD) in Behavioural Science, Psychology, Cognitive Science, Data Science, or a related field.

- Experience working in fintech, e-commerce, or digital platforms, focusing on customer engagement and decision-making.

- Familiarity with machine learning techniques and predictive analytics to model user behaviour.

- Hands-on experience with behavioural data visualisation tools and dashboard creation.

- Knowledge of neuropsychology, cognitive bias theory, or consumer psychology research methodologies.

- Experience conducting cross-cultural behavioural research to understand global user behaviour differences.

- Understanding of regulatory and ethical considerations in behavioural experimentation and psychometric assessments.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratising access to finance across emerging markets. Our team operates across offices in Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen connections with colleagues and partners.

We value the impact of working together in person, believing it often delivers results that remote work cannot fully achieve. While work-from-home (WFH) is available for specific requests or situations, our culture emphasises the advantages of being physically present and engaged as a team.

We are entering an exciting phase of hyper-growth, expanding into new markets, scaling operations, and evolving our structures to shape the future of Credable in 2025. We are looking for energetic, curious individuals who are passionate about our vision and eager to create value while driving innovation and growth in the markets we operate in. We’re thrilled to have you join us as we reshape the financial landscape in emerging markets.

Benefits

- Health Insurance for you and your direct dependants.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities (Internal and External).

Full Stack Developer

The Role

The Full Stack Developer will play a crucial role in shaping the company’s technology decisions. This position involves overseeing the technology budget and ensuring its alignment with the company’s vision.

The Full Stack Developer will primarily be responsible for leading a development and support team and managing the development of Credable’s proprietary technology stack. Additionally, the Full Stack Developer will be accountable for developing and managing products that support the company’s strategy and growth as we expand into new markets with various B2B partners.

Key Responsibilities

- You will work closely with the software systems engineer or other technical leaders to fully understand subsystem and component specifications, providing input and recommending changes to facilitate efficient and effective development.

- Actively participating in the ongoing evolution of company-wide best practices, standards, and policies related to software development.

- Under the guidance of the systems engineer or project leader, you will assist in managing the team’s technical infrastructure, including repositories, build systems, and testing environments, ensuring the robustness and efficiency of our development processes.

- Building high-quality applications that adhere to project briefs, with a focus on delivering rich user interfaces and custom UI designs. Developing and maintaining code to a high standard within IT development and maintenance projects will be a key aspect of your role, ensuring that all code is clean, efficient, and aligned with our coding standards.

- Regularly auditing existing developments for integrity, learning opportunities, and overall development quality will help you and the team continuously improve and adapt to new challenges.

- You will conduct thorough unit testing of your work to ensure functionality, reliability, and performance before deployment. Also responsible for writing clear documentation and commenting on code as needed to ensure that other team members can easily understand and build upon your work.

- There is an expectation to lead by example in helping to deal with on-call support requests as required, bringing your problem-solving skills to maintain the reliability of our software.

Person Specification

- Required

- Extensive Coding Expertise: Demonstrates a strong background in coding with extensive hands-on experience across multiple programming languages, including Java, Python, JavaScript, C#, and SQL. Proficiency in frameworks such as React, Angular, Node.js, and Django is highly desirable.

- Collaborative Team Player: Experienced in working closely with product owners, project managers, product designers, and business teams to deliver high-quality software solutions.

- Fintech Product Development: Has a proven track record in developing and delivering fintech products, with a deep understanding of the unique challenges and requirements of this sector.

- Practical and Results-Oriented: A hands-on, practical manager who is hardworking and focused on achieving high-quality outcomes through effective execution and problem-solving.

- Technical: Proficient in software development methodologies such as Agile and Scrum. Strong understanding of API development, microservices architecture, and cloud technologies (e.g., AWS, Azure, or Google Cloud Platform). Familiarity with CI/CD pipelines, version control systems (e.g., Git), and automated testing frameworks is also essential.

- Preferred

- Understanding of the East African Mobile Money Landscape: Well-versed in the East African mobile money ecosystem, including the regulatory environment and consumer behaviours.

- Knowledge of MNOs and Financial Institutions: Possesses a solid understanding and experience in collaborating with Mobile Network Operators (MNOs) and financial institutions, particularly within the fintech industry.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratising access to finance across emerging markets. Our team operates across offices in Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen connections with colleagues and partners.

We value the impact of working together in person, believing it often delivers results that remote work cannot fully achieve. While work-from-home (WFH) is available for specific requests or situations, our culture emphasises the advantages of being physically present and engaged as a team.

We are entering an exciting phase of hyper-growth, expanding into new markets, scaling operations, and evolving our structures to shape the future of Credable in 2025. We are looking for energetic, curious individuals who are passionate about our vision and eager to create value while driving innovation and growth in the markets we operate in.

Data Science and Analytics Lead

The Role

Credable leverages telco, banking, and alternative data to build credit models for the underbanked. The Data Science and Analytics Lead will drive the development of credit risk models, predictive analytics, and operational efficiency.

Key challenges include integrating multi-source data, strengthening model governance, automating data processes, and scaling infrastructure for rapid decision-making and market expansion.

Key Responsibilities

- Develop and execute the data science strategy to support business growth, embedded finance, and new market expansion.

- Leverage AI and behavioral insights to enhance credit performance, customer engagement, and savings adoption.

- Work with product, risk, and engineering teams to integrate data science into decision-making processes.

- Build and refine AI-powered credit scoring models ensuring performance, fairness, and explainability.

- Lead experimentation and A/B testing for underwriting, portfolio management, and product innovation.

- Expand data science capabilities to support multiple markets with scalable solutions.

- Ensure data integrity, security, and compliance across all data science initiatives.

- Drive best practices in model development, MLOps, and responsible AI.

- Promote cross-functional collaboration to maximize data science impact across the organization.

Person Specification

- Required:

- Strong background in data science, machine learning, and AI, with experience in credit risk modeling.

- Deep understanding of AI governance, model transparency, and regulatory compliance.

- Hands-on experience with MLOps, model deployment, and automated monitoring solutions.

- Strong analytical mindset with a proven ability to drive business impact.

- Excellent leadership skills, with the ability to mentor and build high-performing teams.

- Bachelor's degree in Statistics, Mathematics, Physics, Computer Science, Data Science, Engineering, Economics, Financial Engineering, Actuarial Science, or a related discipline.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a passion for building the future of banking and democratizing access to finance across emerging markets. Our team operates across Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen relationships.

We emphasize in-person collaboration while allowing work-from-home for specific cases. Our culture values teamwork, engagement, and direct problem-solving.

Benefits

- Health Insurance for you and your dependents.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities.

User Acceptance Tester (UAT)

The Role

The User Acceptance Tester (UAT) will ensure our product applications meet business and user requirements before deployment. This role is crucial in validating that new features, updates, and integrations function as expected and provide a seamless user experience.

Working closely with business teams, developers, and product managers to create test cases, execute user-focused testing, and identify any issues that could impact usability or performance. You will play a key role in simulating real-world scenarios, ensuring compliance with security and regulatory standards, and providing structured feedback to enhance product quality.

Position title: User Acceptance Tester (UAT)

Reports to: Head of Product and Projects

Coverage: UAE (HQ), Kenya, Tanzania, and Uganda + other new markets

Base: Nairobi, Kenya

Key Responsibilities

- Develop, execute, and maintain UAT test cases and test plans based on business requirements and user scenarios.

- Validate that new features, system updates, and integrations function correctly and meet end-user expectations.

- Collaborate with product managers, developers, and business stakeholders to understand requirements and define acceptance criteria.

- Simulate real-world user interactions and workflows to identify potential issues or usability gaps.

- Document test results, log defects, and work closely with development teams to ensure timely resolution.

- Support the product team to update and maintain documentation of new features and deployments per product requirements.

- Ensure compliance with security, regulatory, and data privacy standards within the fintech environment.

- Provide structured feedback on system functionality, performance, and usability improvements.

- Support business teams and clients during the testing phase, ensuring smooth handover and user adoption.

- Contribute to continuous improvement by refining UAT processes and identifying automation opportunities where applicable.

Person Specification

- Required

- This position requires a strong understanding of testing methodologies, business processes, and end-user expectations in a fintech environment.

- Strong knowledge of testing methodologies, test case creation, and execution for end-to-end user validation.

- Ability to collaborate with business teams, stakeholders, and developers to define and refine UAT scenarios.

- Experience writing clear and structured test scripts based on business processes and user workflows.

- Proficiency in logging, tracking, and managing defects using tools such as Jira, Bugzilla, or TestRail.

- Understanding of FinTech applications and the ability to validate compliance with security, regulatory, and data privacy standards.

- Experience conducting functional, usability, and regression testing to ensure smooth user experiences. Provide structured feedback on user experience issues and identify potential areas of improvement.

- Strong communication skills to document findings, report issues, and work closely with developers for resolution.

- Experience in working within Agile environments and participating in sprint testing cycles.

- Familiarity with API testing and validating system integrations from an end-user perspective.

- Experience using test automation tools to streamline repetitive UAT processes.

- Knowledge of performance testing tools to assess system responsiveness and reliability.

- Familiarity with SQL for data validation during UAT processes.

- Exposure to cloud-based testing environments such as AWS, Azure, or Google Cloud.

- Preferred

- ISTQB or other relevant UAT/QA certifications.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratising access to finance across emerging markets. Our team operates across offices in Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen connections with colleagues and partners.

We value the impact of working together in person, believing it often delivers results that remote work cannot fully achieve. While work-from-home (WFH) is available for specific requests or situations, our culture emphasises the advantages of being physically present and engaged as a team.

We are entering an exciting phase of hyper-growth, expanding into new markets, scaling operations, and evolving our structures to shape the future of Credable in 2025. We are looking for energetic, curious individuals who are passionate about our vision and eager to create value while driving innovation and growth in the markets we operate in. We’re thrilled to have you join us as we reshape the financial landscape in emerging markets.

Benefits

- Health Insurance for you and your direct dependants.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities (Internal and External).

Database Administrator - Credable Technology Solutions

Who Are Credable

Credable is transforming financial services in emerging markets with its best-in-class Digital Banking Platform...

The Role

We are seeking a highly skilled Database Administrator (DBA) to design, implement, and maintain our database systems...

Key Responsibilities

- Design, configure, and maintain database systems across cloud and on-premises environments...

- Monitor database performance and health...

- Implement and manage backup and disaster recovery strategies...

Person Specification

Required:- Proven experience in database administration...

- Strong expertise in SQL and NoSQL databases...

- Exposure to big data technologies (e.g., Hadoop, Snowflake)...

- Experience working with containerized environments...

Culture at Credable

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking...

Benefits

- Health Insurance for you and your dependants

- Group Bonus Policy

- Long Term Incentive Plan (LTIP)

Data Engineer

Person Specification

- Reports to: Chief Financial Officer / Head of Data & Analytics

- Coverage: UAE (HQ), Kenya, Tanzania, and Uganda + other new markets

- Base: Nairobi, Kenya / Dubai, UAE

- Limited travel but may be required

Purpose

We are looking for a Data Engineer to join our Data Team as we continue to build out our Credit Scoring Capabilities and Data Analytics functions. We are looking for someone who is obsessed with data and understands how it can be transformational in the products that customers can access the decision making power it holds. Someone who is passionate about designing and maintaining scalable data pipelines.

The successful candidate will be responsible for designing, building, and maintaining the data infrastructure required for our credit scoring models. The Data Engineer will collaborate with our data science and software engineering teams to ensure that our data pipeline is efficient, scalable, and reliable.

Key Duties

Contract / project implementation

- Design, build, and maintain the data infrastructure required for our credit scoring models.

- Collaborate with data science and software engineering teams to ensure that data is collected, processed, and stored efficiently.

- Identify and implement ways to improve the performance and reliability of the data pipeline

- Ensure that data quality is maintained throughout the data pipeline

- Develop and maintain data models that support our credit scoring models

- Develop and maintain ETL workflows that extract data from various sources, transform it, and load it into our data warehouse

- Optimize queries and data processing algorithms to improve performance

- Design and maintain data security and privacy policies

- Monitor and troubleshoot data pipeline issues

- Identify opportunities for data acquisition

- Develop analytical tools, programs and reports

- Deliver updates to stakeholders based on analytics

- Stay up-to-date with new technologies and trends in data engineering

Professional Qualifications & Attributes

- Bachelor's degree in Computer Science, Software Engineering, or a related field

- Minimum of 5 years of experience in data engineering

- Proficiency in SQL and experience with relational databases such as MySQL or PostgreSQL

- Experience with Big Data technologies such as Hadoop, Spark, or Kafka

- Familiarity with data modeling and ETL processes

- Strong programming skills in Python, Java, or Scala

- Excellent communication and collaboration skills

- Familiarity with cloud platforms such as AWS or Azure is a plus

- Knowledge of credit scoring models and regulations is a plus

The Ideal Candidate Will Be a Leader Who Demonstrates

- Practical, hardworking, hands-on results oriented manager with the ability to achieve high quality results.

- Ability to work effectively with third parties.

Please include the role title in the subject of your e-mail.

Data Scientist

Person Specification

- Reports to: Chief Financial Officer / Head of Data & Analytics

- Coverage: UAE (HQ), Kenya, Tanzania, and Uganda + other new markets

- Base: Nairobi, Kenya / Dubai, UAE

- Travel: Limited travel but may be required

Purpose

We are looking for a Data Scientist to join our Data Team as we continue to build out our Credit Scoring Capabilities and Data Analytics functions. We are looking for someone who is highly analytical and detail-oriented Data Scientist who is passionate about building and maintaining credit risk models. Someone who is obsessed with data and understands how it can be transformational in the products that customers can access the decision-making power it holds.

Someone who is passionate about designing and maintaining scalable data pipelines. The successful candidate will be responsible for building and maintaining credit risk models, developing predictive analytics, and conducting data analysis to identify insights that drive our business forward.

Key Duties

Contract / project implementation

- Work with 3rd party partners on credit scoring, modeling and evaluation of portfolio of lending products

- Develop credit risk models using statistical and machine learning techniques

- Analyze credit data to identify patterns and trends that inform our credit decision-making process

- Collaborate with our data engineering and software engineering teams to ensure that data is collected, processed, and stored efficiently

- Develop predictive models for credit risk assessment, fraud detection, and other business use cases

- Monitor and analyze the performance of credit risk models, and make recommendations for improvement

- Develop and maintain data dashboards and reports to communicate insights to stakeholders

- Stay up-to-date with new technologies and trends in data science and credit scoring

Professional Qualifications & Attributes

- Master's degree in Computer Science, Statistics, Mathematics, or a related field

- Minimum of 5 years of experience in data science or a related field

- Strong proficiency in programming languages such as Python or R

- Experience with statistical and machine learning techniques such as logistic regression, decision trees, and random forests

- Experience with data visualization tools such as Tableau or PowerBI

- Knowledge of credit risk models and regulations

- Excellent communication and collaboration skills

- Experience with cloud platforms such as AWS or Azure is a plus

- Proficient in Microsoft Excel and Powerpoint.

The Ideal Candidate Will Be a Leader Who Demonstrates

- Practical, hardworking, hands-on results oriented manager with the ability to achieve high quality results.

- Ability to work effectively with third parties.

How to Apply

To apply, send a full CV and a supporting statement highlighting your experience and skills against the role requirements to jobs@credable.io. Please include the role title in the subject of your email.

Head of Business Development

The Role

We’re looking for a driven and experienced Head of Business Development to help take Credable to the next level across African, East & Central Asian markets. If you have a strong background in the startup world and deep experience in fintech, banking, or payment solutions, this could be the perfect role for you.

In this role, you will be focused on identifying new business opportunities, building strong partnerships, and ensuring a smooth onboarding process for our business customers to help us hit our revenue goals and expand into new markets.

Key Responsibilities

- Drive business development initiatives across Africa and APAC, ensuring a strong pipeline of opportunities for Credable’s growth.

- Conduct market research to identify trends, opportunities, and competitive insights for strategic decision-making.

- Build and manage partnerships with Mobile Network Operators, banks, and B2C networks to expand market presence.

- Develop client relationships by understanding needs, delivering value, and fostering long-term partnerships.

- Craft and present compelling proposals that showcase Credable’s value proposition and drive business growth.

- Lead contract negotiations, securing agreements aligned with Credable’s strategic objectives.

- Collaborate with product, marketing, and operations teams to ensure seamless execution of growth strategies.

- Set and exceed revenue targets, driving measurable impact on Credable’s expansion.

- Ensure compliance with regulatory standards while providing insights for data-driven strategic planning.

- Represent Credable at industry events to strengthen brand presence and thought leadership.

Person Specification

- Required:

- 5+ years of experience in business development within fintech, banking, or payment solutions.

- Proven track record in driving business growth within the startup ecosystem.

- Strong understanding of financial inclusion and digital banking solutions tailored to emerging markets.

- Strong negotiation, networking, and relationship management skills.

- Entrepreneurial mindset with a proactive approach to problem-solving and business expansion.

- Preferred:

- Experience working in multinational environments, particularly within emerging markets.

- Familiarity with regulatory frameworks across African, East & Central Asia regions.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a passion for building the future of banking and democratizing access to finance across emerging markets. Our team operates across Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen relationships.

We emphasize in-person collaboration while allowing work-from-home for specific cases. Our culture values teamwork, engagement, and direct problem-solving.

Benefits

- Health Insurance for you and your dependents.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities.

Head of Product

The Role

The Head of Product is a highly cross-functional role that bridges product, technology, operations, and data to drive business objectives. Currently, the team includes a cross-functional lead and a UX designer, with plans to expand due to the department's critical role in the company’s success.

This role involves leading diverse projects, products, and processes to drive change, build capacity, and unlock growth.

Key Responsibilities

- Oversee product growth and delivery across all markets, ensuring alignment with company objectives.

- Lead cross-functional teams to drive collaboration between engineering, design, marketing, and operations.

- Standardize product development with clear documentation, including specifications and launch requirements.

- Manage P&L and drive ROI for each product.

- Conduct market and competitor research to identify trends and opportunities.

- Use customer insights and data to inform product roadmap and feature prioritization.

- Act as a subject matter expert and build strong relationships with stakeholders.

Person Specification

- Required:

- Bachelor’s degree in Product Management, Commerce, Finance, Business Administration, or a related field.

- 5+ years of experience in product management, operations, or consulting.

- Experience in customer support, product ownership, UX research, or business analysis.

- Strategic thinker with the ability to translate business goals into product strategies.

- Preferred:

- Experience in fintech is a strong plus.

- Strong analytical and problem-solving abilities.

- Exceptional communication skills and ability to lead teams.

- Passion for fintech innovations and emerging technologies.

Why Join Us?

At Credable, we are a fast-paced, high-performing team driven by a passion for building the future of banking and democratizing access to finance. We operate across Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen relationships.

We value in-person collaboration while allowing work-from-home for specific cases.

Benefits

- Health Insurance for you and your dependents.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities.

Head of Projects

The Role

The Head of Projects role is a critical position that cuts across the entire organization and engages cross-functionally. This role requires a highly organized and driven individual to support the organization in achieving ambitious 2025 goals while shaping the future of digital banking.

Key Responsibilities

- Establish and implement scalable project management methodologies, standards, and tools.

- Lead project planning, defining objectives, scope, deliverables, and timelines with key stakeholders.

- Track progress, mitigate risks, and ensure adherence to project plans.

- Implement quality assurance processes and conduct audits.

- Provide senior leadership with project status reports and key insights.

- Continuously improve project management practices by adopting industry best practices.

- Lead, mentor, and develop a high-performing project management team.

- Build strong relationships with internal teams and external partners.

Person Specification

- Required:

- 5+ years of experience leading and delivering complex projects, preferably in fintech or financial services.

- Expertise in project management methodologies, tools, and frameworks.

- Strong analytical and problem-solving skills.

- Excellent communication and stakeholder management skills.

- Preferred:

- Project management certification (PMP, PRINCE2, Agile).

- Experience in startup environments.

- Bachelor’s degree in business administration, computer science, engineering, or a related field.

Why Join Us?

At Credable, we are a fast-paced, high-performing team driven by a passion for building the future of banking and democratizing access to finance. Our team operates across Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen relationships.

We value in-person collaboration while allowing work-from-home for specific cases.

Benefits

- Health Insurance for you and your dependents.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities.

BI Analyst

The Role

Join our dynamic team as a Business Intelligence (BI) Analyst, where you'll play a crucial role in shaping the data-driven decision-making process within our organization. You will leverage your analytical skills to turn data into actionable insights, driving the strategic direction of our products and services.

Key Responsibilities

- Track and report on key performance metrics related to business initiatives and products.

- Collaborate with teams to optimize data collection, quality, and processing.

- Manage multiple product-related tasks and projects, with a 6-9 month ramp-up period.

- Stay current with BI trends, recommending and implementing improvements to BI tools and processes.

- Participate in advanced analytics projects using Python for predictive modeling and machine learning.

Person Specification

- Experience with Databricks supports Credable’s data-driven approach.

- 3+ years of experience with strong SQL/Python skills for managing diverse datasets.

- Ability to turn complex data into actionable insights, including data storytelling.

- Strong problem-solving skills to enhance credit risk strategies and customer segmentation.

- Strong collaboration and stakeholder management skills.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratizing access to finance across emerging markets. Our team operates across Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen relationships.

We emphasize in-person collaboration while allowing work-from-home for specific cases.

Why Join Us?

- Health Insurance for you and your dependents.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities.

Data Engineering Lead

The Role

The Data Engineering Lead will be responsible for leading the Data Engineering team and taking ownership of tasks related to data engineering, data modeling, ETL (Extract Transform Load), data warehousing, and data analytics. This role is based in Nairobi, Kenya, with flexibility for remote work, but we encourage a balance between office and remote work.

Key Responsibilities

- Lead and manage the Data Engineering team, ensuring alignment with department objectives and key results.

- Oversee day-to-day operations, balancing incoming business requests with planned roadmap execution.

- Own end-to-end project delivery, including requirement gathering, solution design, development, validation, and deployment.

- Enhance the data ecosystem by improving automation, robustness, pipeline testing, and observability.

- Optimize infrastructure for cost-effective data movement and storage.

- Develop and implement data governance processes to ensure compliance with relevant laws and regulations.

Person Specification

- Required:

- Bachelor's or Master's degree in Computer Science, Data Science, Engineering, or a relevant field.

- Minimum 7 years’ industry experience working in a Data-related field.

- Proven track record of developing and maintaining ETL pipelines at scale.

- Deep understanding of Data Modeling & Data Warehouse structures.

- Experience in Data Analytics and managing business stakeholders’ reporting/analytics requirements.

- Proficient in SQL (Spark is a bonus).

- Experience working with structured and unstructured data.

- Experience with cloud platforms (AWS, Azure, GCP).

- Strong problem-solving and analytical skills.

- Excellent written and verbal communication skills in English.

Why Join Us?

At Credable, we are a fast-paced, high-performing team driven by a passion for building the future of banking and democratizing access to finance. Our team operates across Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen relationships.

We value in-person collaboration while allowing work-from-home for specific cases.

Benefits

- Health Insurance for you and your dependents.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities.

Product Manager

Person Specification

- Reports to: Head of Product / COO

- Coverage: Kenya, Uganda, Tanzania

- Base: Nairobi, Kenya

- Travel: East Africa primarily with travel to HQ and other markets as may be required

Purpose

Responsible for leading and driving the vision, strategy, business requirements, roadmap, and execution of the company’s new and existing products in order to deliver a best-in-class acceptance offering and pleasurable journey for Credable’s customers across its offering.

Key Duties

Research and Analysis

- Carry out market research on a regular basis to ensure we maintain a competitive edge

- Disseminate key learnings to team members to inform opportunities for improvement

Product Scope and Delivery

- Lead the Product delivery and growth for Credable products in Kenya.

- Advocate and defend product changes using qualitative and quantitative data

- Create Product Requirement documents and get internal approval for implementation.

- Manage all aspects of the project with Credable Partners including Telco’s, FinTech’s and Banks. Interacting with their internal teams to ensure timely delivery of products.

Product Growth

- Own the P&L responsibilities of the product and the achievement of KPIs based on budgeted figures and the business plan.

- Drive initiatives to drive uptake of the product in collaboration with our Partners.

Relationships

- Build, maintain and grow relationships with key stakeholders for the product including to but not limited to the telco, and bank.

- Be the team champion to ensure team alignment, advocate product and be the subject matter expert for our internal tools

Reporting

- Share weekly reports on product delivery progress and / or performance across all channels with internal and external teams.

Professional Qualifications & Attributes

- Bachelor’s degree in Commerce, Finance, Business Administration or other related field.

- 3+ years experience in operations or consulting.

- 1-3 years product experience preferably in a fintech.

The Ideal Candidate Will Be a Leader Who Demonstrates

- Excellent analytical and problem-solving skills with experience product delivery

- Effective communicator that can listen, surface timely questions as well as motivate others

- Curiosity and knowledge of technical and product innovation and trends

- Ability to organize, prioritize and handle multiple time-sensitive tasks in a demanding environment working with cross functional teams.

- Have a ‘Customer First’ attitude.

Please include the role title in the subject of your e-mail.

Head of Testing Lab

The Role

The Head of Testing Lad is a critical leadership position to lead our Quality Assurance function and drive quality standards across our engineering teams. This role is responsible for ensuring the integrity of our platform through robust testing strategies, automation frameworks, and governance structures. Acting as the bridge between domain-specific QA teams, the Head of Testing Lab will coordinate efforts across the organisation, foster a cohesive testing strategy, and implement continuous improvements.

Our 2025 roadmap and OKRs are ambitious and focused around tripling our live portfolio, while also diversifying our products in terms of markets, partners, and outcomes. This position requires a highly organised and driven individual that can support the organisation in achieving these lofty goals for 2025, while also shaping the future of digital banking in the space at large.

Position title: Head of Testing Lab

Reports to: Head of Product and Projects

Coverage: UAE (HQ), Kenya, Tanzania, and Uganda + other new markets

Base: Nairobi, Kenya with occasional travel.

Key Responsibilities

- Develop and implement QA strategies that align with organisational quality standards, including establishing automated testing frameworks and governance structures.

- Build, mentor, and scale high-performing QA teams, fostering both manual and automation testing capabilities while creating a culture of excellence.

- Drive crisis management and resolution for complex projects, ensuring client satisfaction and timely delivery of high-quality solutions.

- Lead the design and implementation of test automation processes, focusing on UI, API, and security testing to improve efficiency and reduce testing cycle times.

- Define, measure, and maintain quality metrics in collaboration with cross-functional teams.

- Manage test planning and execution, ensuring comprehensive test plans, scripts, and cases are developed and reviewed.

- Ensure effective defect documentation and reporting, working closely with development teams to resolve issues efficiently.

- Support client acceptance testing and provide technical expertise to facilitate successful deployments.

- Maintain up-to-date documentation, including user manuals, product release notes, and training materials.

- Champion test automation and strategic quality initiatives, setting objectives and implementing metrics to ensure continuous improvement across all teams.

Person Specification

- Required

- Minimum 8+ years of experience in Quality Assurance, with at least 3+ years in a leadership or managerial role.

- Strong hands-on experience in UI, API, and Security test automation, with a proven track record of implementing and maintaining test automation frameworks.

- Software testing methodologies: Deep understanding of manual and automated testing techniques, including unit, integration, functional, regression, and performance testing.

- Crisis management & issue resolution: Experience in troubleshooting, risk assessment, and crisis resolution across complex software projects.

- Defect management & reporting: Proficiency in bug tracking tools (e.g., JIRA, TestRail, or similar) and ability to analyse, document, and drive defect resolution effectively.

- Quality governance & metrics: Ability to define, measure, and maintain quality metrics to track performance and improvement across QA teams.

- Cross-functional collaboration: Strong experience working with engineering, product, and business teams to ensure seamless quality assurance processes.

- Agile & DevOps integration: Experience embedding QA practices into Agile, CI/CD, and DevOps environments, ensuring efficient software delivery cycles.

- Stakeholder management: Ability to engage with senior leadership and clients, acting as a trusted advisor on quality engineering best practices.

- Preferred

- Experience working with AWS, Azure, or GCP testing environments.

- Programming & scripting skills: Proficiency in one or more languages such as Python, Java, JavaScript, or C# for test automation.

- Performance & security testing: Hands-on experience with performance testing tools (JMeter, LoadRunner) and security testing frameworks.

- Regulatory & compliance knowledge: Exposure to industry-specific compliance and security standards (e.g., ISO 27001, PCI-DSS, GDPR).

- Test data management: Experience in test data creation and management strategies for complex enterprise applications.

- Experience in fintech or financial services: Prior exposure to banking, fintech, or financial platforms is highly desirable.

Our Culture

At Credable, we are a fast-paced, high-performing team driven by a shared passion for building the future of banking and democratising access to finance across emerging markets. Our team operates across offices in Dubai, Nairobi, Dar es Salaam, Kampala, Maputo, and Porto, with frequent travel to strengthen connections with colleagues and partners.

We value the impact of working together in person, believing it often delivers results that remote work cannot fully achieve. While work-from-home (WFH) is available for specific requests or situations, our culture emphasises the advantages of being physically present and engaged as a team.

We are entering an exciting phase of hyper-growth, expanding into new markets, scaling operations, and evolving our structures to shape the future of Credable in 2025. We are looking for energetic, curious individuals who are passionate about our vision and eager to create value while driving innovation and growth in the markets we operate in. We’re thrilled to have you join us as we reshape the financial landscape in emerging markets.

Benefits

- Health Insurance for you and your direct dependants.

- Group Bonus Policy.

- Long Term Incentive Plan (LTIP).

- Mental Health and Wellbeing Platform.

- Learning & Development Opportunities (Internal and External).